Trading Pit History

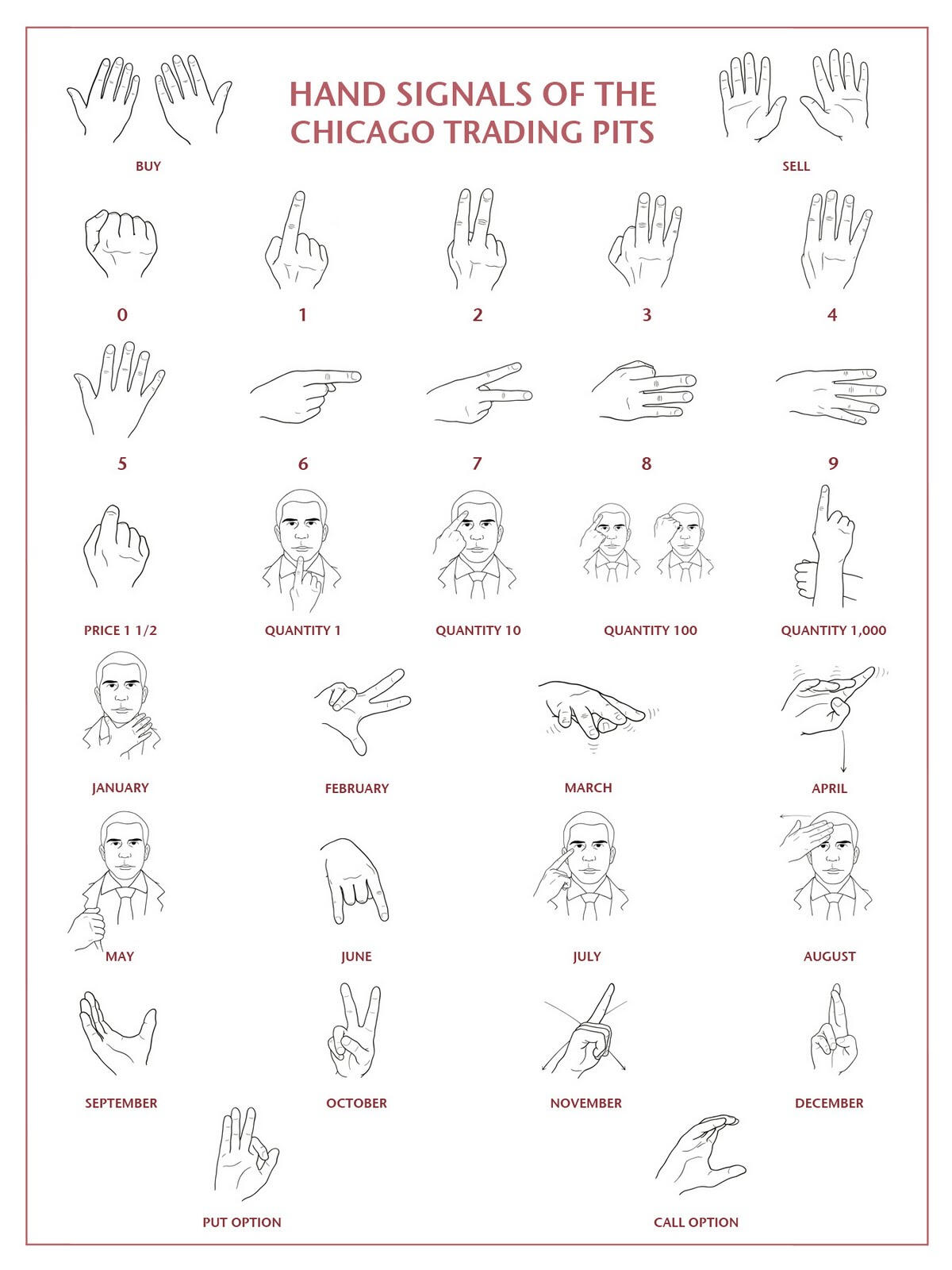

To preserve, for historical record, the hand signals of open outcry pit trading.The prior version of this website got buggy but is archived on the wayback machine internet archive. This current page is a simple landing page until another website is fully restored.

History

In the age of digital trading and quiet computer terminals, it's easy to forget that the financial world once relied on a colorful, silent language all its own. For over a century, traders on bustling exchange floors communicated through an intricate system of hand signals - a practice now largely consigned to history.This unique form of communication emerged in the early 1900s, born out of necessity in the noisy, chaotic environment of trading pits. The earliest signals were simple, allowing traders to convey basic "buy" and "sell" orders, along with prices and quantities, without shouting themselves hoarse.The system evolved significantly in 1972 when the Chicago Mercantile Exchange introduced financial futures. This innovation led to more complex signals, known as "arb" (short for arbitrage), enabling traders to quickly capitalize on fleeting price discrepancies between markets.As trading volumes exploded in the 1970s and '80s, so did the complexity of these gestures. New signals emerged to handle intricate transactions and the growing variety of financial products. What began as a practical solution had become a rich, nuanced language all its own.While Chicago was the epicenter of hand signal development, trading floors worldwide adapted and created their own variations. Despite these regional differences, the influence of Chicago's system remained strong throughout the industry.Today, with most trading conducted electronically, these hand signals have largely disappeared from active use. They remain, however, a fascinating chapter in financial history - a testament to human ingenuity and adaptability in the face of challenging work conditions.

Book

Trading Pit Hand Signals by Ryan Carlson

The advent of electronic trading has shuttered virtually every futures trading floor in the world, putting an end to the 150-year reign of the open outcry trading pit—those disorderly, deafening places where massive volumes of commodities could be bought or sold with a gesture. Trading Pit Hand Signals is a retrospective look at the history and function of open outcry trading pits with a specific focus on the trading floors of Chicago, New York, London, Paris and Singapore. Using engaging portrait photography of former pit traders, Trading Pit Hand Signals catalogs over 400 hand signals that made commodities futures trading possible. Researched and written by a former pit trader who utilized the hand signals during his early career on various trading floors, Trading Pit Hand Signals records the history and sometimes ribald humor of the financial industry’s most fascinating “lost language.”

About

Ryan Carlson has worked at the Kansas City Board of Trade, Chicago Board of Trade, Chicago Mercantile Exchange and New York Mercantile Exchange in addition to visiting the trading floors of the Minneapolis Grain Exchange, Montreal Exchange, London Metals Exchange, Bolsa Mercadorias & Futuros in Sao Paulo, and Singapore International Monetary Exchange. Carlson remains an independent trader on the screen.